STATE GOVERNMENT CONTRACTING

&

Minority Business Certifications

WHY CHOOSE CASHBOX

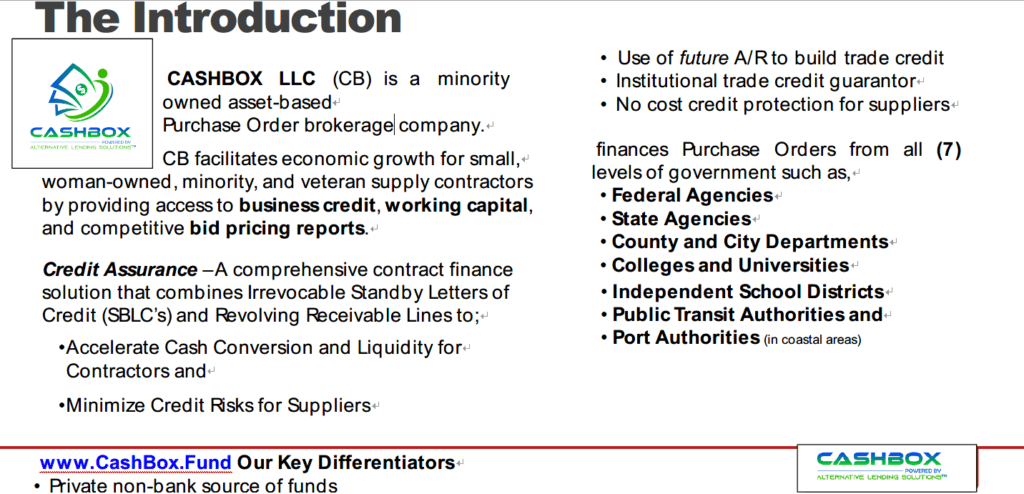

CASHBOX mission is to assist entrepreneurs in turning their ideas and visions into profitable businesses. We have helped outstanding ideas develop into viable businesses that make a difference in their sector and beyond by leveraging our knowledge. Our abilities to help businesses have been bringing a lot of good attention to CASHBOX as we help others people can not stop talking about their excitement to continue working with CASHBOX for a long time to come.

We make long-term investments in our businesses because we know that success requires hard work, dedication, and sheer endurance. Therefore, we provide personal coaching to our partners from the start and all the resources and expert counsel they require to turn their ideas into abrupt realities.

Based on clients reviews Cashbox has learned others in the industry are charging $3,000 USD just to become certified, making our rates very competitive and affordable.

Cashbox prides ourselves in being able to help Veterans, Service Disabled Veterans, HUBZONE and minorities from all across USA with Business Development program that plays a crucial role in promoting the development and competitiveness of small businesses owned by certified socially and economically disadvantaged individuals in the United States.

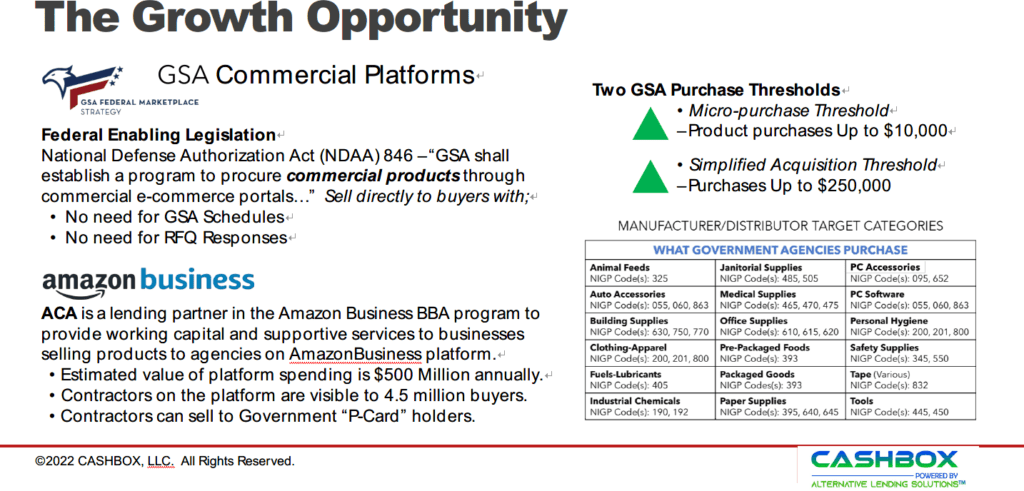

This program equips businesses with a strategic edge in the federal marketplace. Federal agencies are incentivized to allocate a portion of their contracts to certified enterprises, thus amplifying the chances of securing contracts for program participants.

In the video above you may listen to how Cashbox is able to help our clients from just about any industry. We enjoy and have an appreciation in being able to help small to medium size businesses tap into revenue and working capital that would otherwise not be available. Learn and build your future with Cashbox. We can help you grow your business today.

HOW DO I KNOW IF GOVERNMENT CONTRACTING IS RIGHT FOR ME?

HOW TO BECOME CERTIFIED AS A MINORITY OWNED BUSINESS

The process is easy. A Cashbox specialist will assist you in gathering all you need to prepare for the application process. Once the documents and questions are filled out Cashbox will complete the self certification process. Once we have your business in the public database you will need to go through a third party verification process that we will setup for you. After your third party verification process we will be waiting for an approval where sometimes we will need to answer questions for any audit. Typically the certification process will take 45-90 days but we can expedite your certification to be under 2 weeks with expedited services.

CALL 203-227-4269 and ask to become certified today.

THE BENEFITS OF BECOMING A CERTIFIED BUSINESS OWNER?

Obtaining certification as a minority owned business (MBE) opens doors to a multitude of opportunities for entrepreneurs of color. To begin the process, research the specific requirements for MBE certification in your area and ensure your business meets the eligibility criteria. Gather necessary documentation, complete the application accurately, and submit it to the appropriate certification agency. Following a review process, successful applicants receive certification, granting access to contracting opportunities, networking events, and minority specific grants and loans. Maintaining compliance with certification requirements ensures ongoing eligibility for these valuable resources, empowering minority owned businesses to thrive in today’s marketplace.

READ MORE ABOUT GOVERNMENT SUPPLY CONTRACTORS

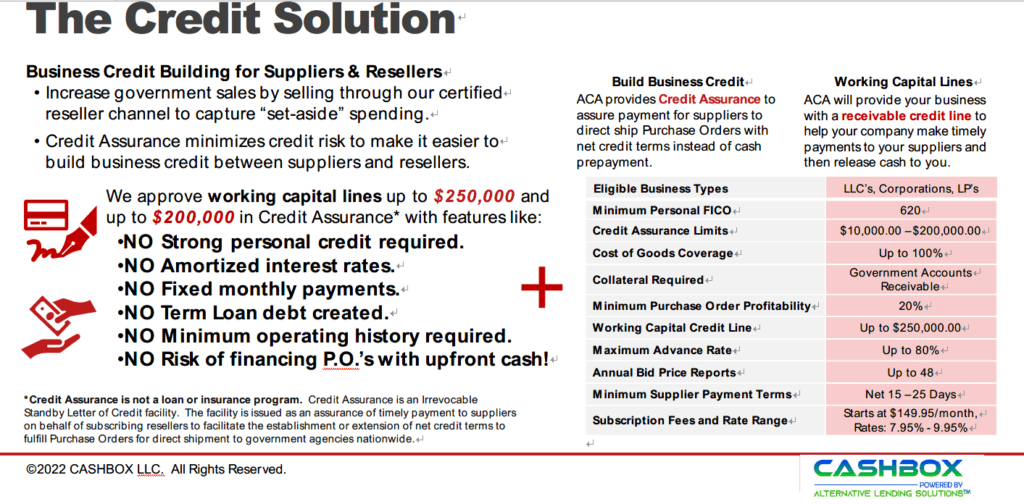

Depending on the type of business you are interested most in we have an Amazon Business model where you profit by becoming a reseller of goods that the US Government is required to buy from a certified MBE business. There is over 500 Million in government spending on the Amazon platform alone every year.